Not all batteries play the same “game”.

Battery storage systems generate revenue through a mix of market and non-market mechanisms, including wholesale arbitrage, offtake agreements, capacity schemes, and more. Operational strategies are therefore shaped by the owner’s commercial objectives – whether it’s energy trading, risk hedging, or portfolio support.

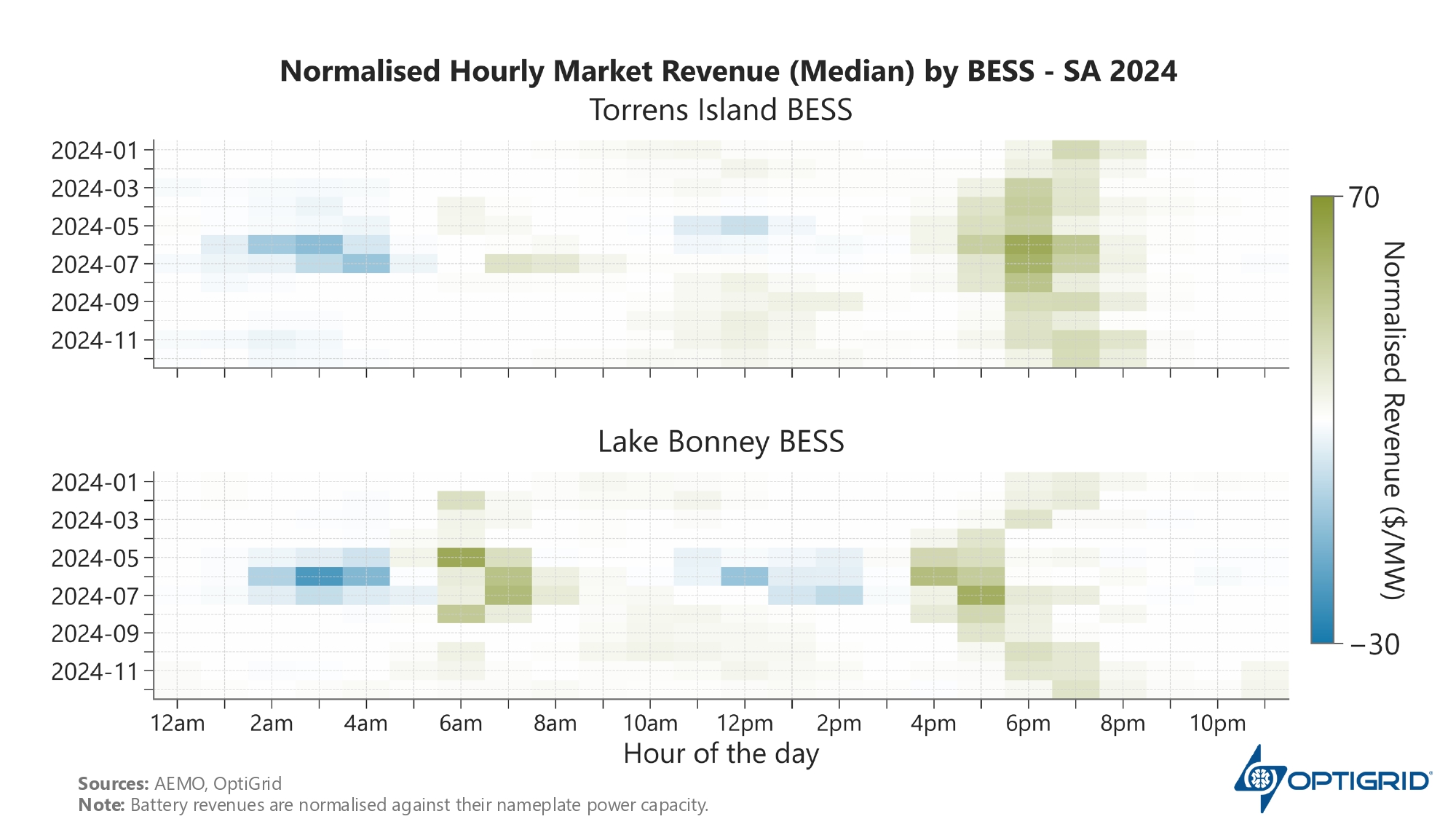

To unpack this, we analysed the average hourly wholesale market revenue across several BESS assets over multiple months in 2024 and visualised the results as heatmaps (below). These charts give a snapshot of when in the day different batteries were dispatched and generated revenue.

As expected, most BESS assets discharged between 4-7pm, aligning with the evening peak, while charging typically occurred in the solar-rich midday hours and occasionally after midnight when prices were lowest.

But patterns vary across regions and ownership models. In Queensland, Bouldercombe BESS had the highest normalised market revenue in 2024, while in SA, Lake Bonney BESS led on this metric. Interestingly, gentailer-operated batteries in both regions showed different behaviour, often delaying discharge and maintaining a higher state of charge into the evening. This suggests a strategic use of storage as a hedge against late-evening volatility. We also observed months where grid support services shifted typical revenue patterns, reinforcing how contractual obligations influence battery dispatch.

Ultimately, while revenue maximisation is critical, optimisation platforms must go beyond short-term trading gains. Our platform, OptiBidder, integrates contract structures and aligns trading decisions with the operator’s commercial objectives – while ensuring the asset delivers strong returns over time.

Subscribe to our newsletter