Intelligent Energy Trading,

Powered by Deep Tech

We help battery owners and operators maximise the value of their portfolios, using market-leading forecasting and trading optimisation.

Trusted by

Built to Maximise Returns from Batteries

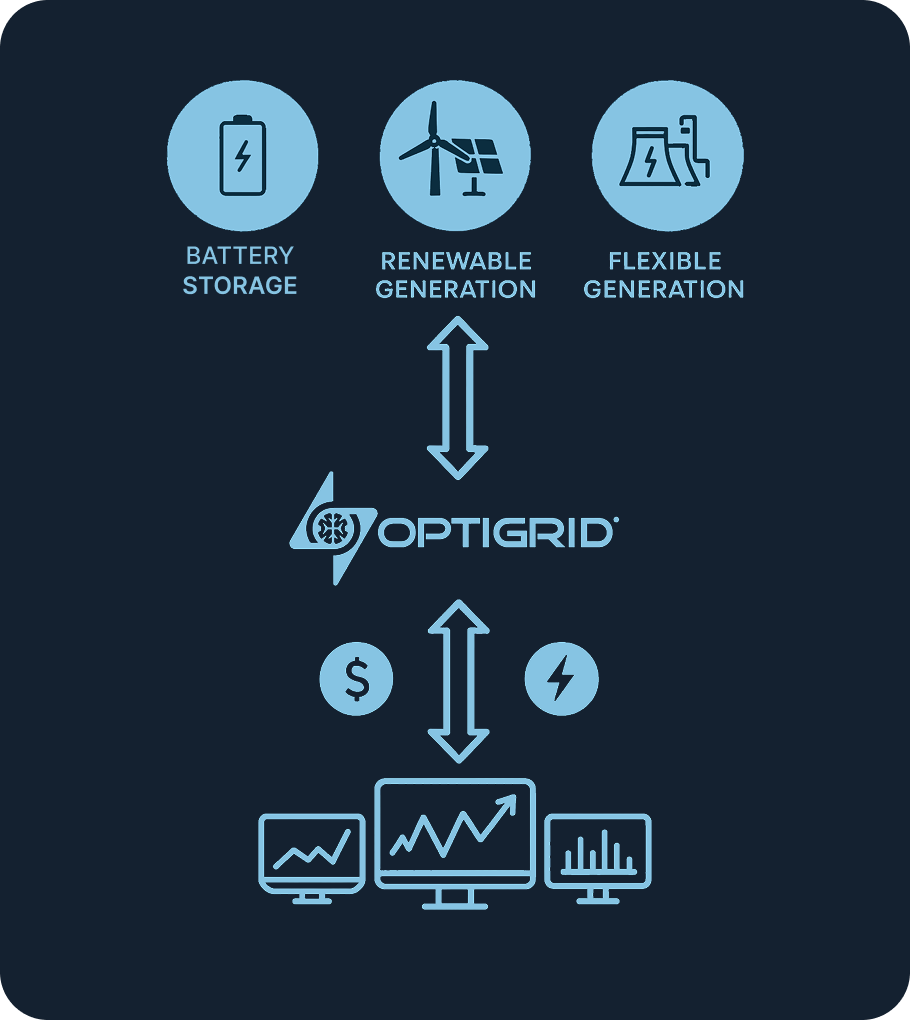

OptiGrid is an Australian asset optimisation and trading intelligence platform for hybrid and stand-alone batteries operating in Australia’s National Electricity Market. Powered by proprietary forecasting and optimisation models, our platform helps you trade with confidence in volatile conditions, manage risk, monitor your assets and maximise lifetime returns.

learn more

- 0MW+

- Optimised Assets

- 10-0%

- Proven Performance Uplift

- 0+ years

- R&D Excellence

Optimising Battery Trading in Volatile Markets

We maximise value for batteries from under 5 MW through to utility-scale projects, tailoring our platform to each project’s commercial goals. With market-leading forecasting and bidding models, we help asset owners, developers and operators make better investment decisions with confidence.

Higher Performance

Smarter models, better decisions, stronger returns

Flexible Platform

Tailored to your asset and strategy

Intelligent Trading Strategies

Algorithms that capture maximum value

Market Integration & Asset Control

Automated control and bidding for assets across all markets

News

From The Blog