Yesterday evening delivered the longest run of extreme prices so far this winter. From 4 to 9 pm, every mainland region spent long stretches with prices mostly around $10,000/MWh, occasionally hitting the Market Price Cap. Sustained low wind generation right as demand ramped into the evening caused the reserve margin to erode, triggering extreme prices.

Most BESS across the NEM entered the afternoon fully charged and were able to discharge at full capacity when the price events hit. Across the NEM, total BESS energy market revenue exceeded $25 million, with several individual assets clearing more than $1 million each.

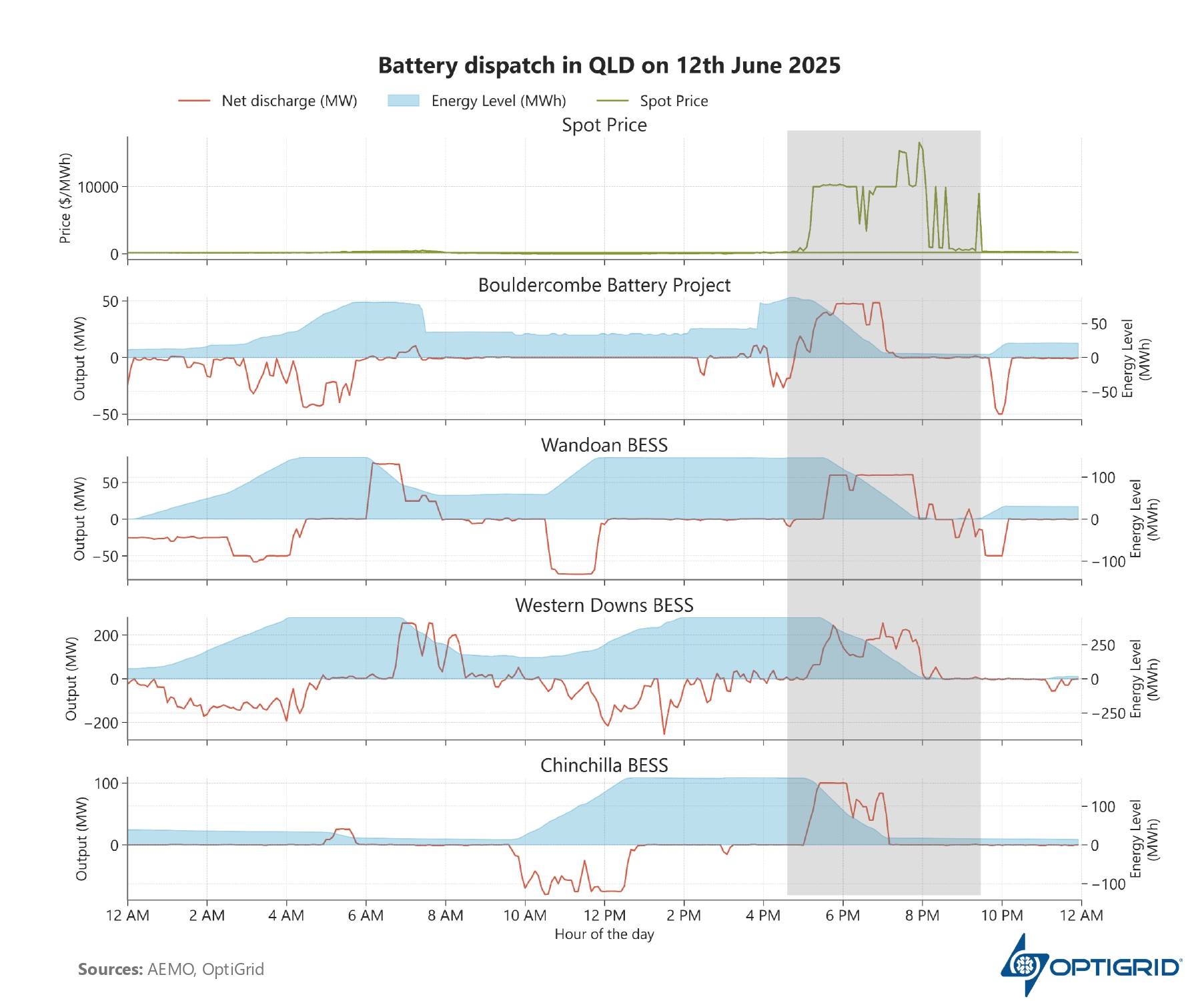

We looked at how different operators dispatched their batteries (all with a maximum 2-hour duration) across this long stretch of scarcity pricing. The charts below show how several batteries responded.

Most began discharging at full capacity as soon as prices neared $10,000, and many ran out of charge well before the end of volatility period. Gentailer-operated batteries, however, showed a different pattern, delaying discharge and maintaining a higher state of charge into the evening. In some occasions, they even passed up many $10,000/MWh intervals earlier on, holding energy so that they could respond to higher prices later in the evening.

This is a clear example of how winter demand combined with low wind can tighten the supply-demand balance and create extreme pricing events.

Want to track BESS performance across different assets and NEM regions? Check out OpenBESS, our free-access platform!

Subscribe to our newsletter