Our journey began at the University of Adelaide, where years of research into machine learning, AI, and optimisation models for price forecasting and battery trading laid our foundation.

Building on our world-leading research, we transitioned into a commercial enterprise, securing support from prominent investors specialising in deep-tech and clean energy ventures, such as IP Group, CEFC, Virescent Ventures, Hostplus, UNSW, and University of Adelaide.

Today, OptiGrid combines cutting-edge data science with decades of practical industry experience. Our team comprises PhD-level researchers, experienced software engineers, and seasoned energy sector professionals.

Our mission is to accelerate the energy transition by unlocking full potential of renewable and battery assets.

Contact UsIn 2018, our Co-Founder, Ali Pourmousavi, had a profound realisation: utility-scale batteries were on the path to revolutionise the grid, but their financial success depended on sophisticated operation and management systems that didn’t yet exist. The challenge was two-fold; batteries needed both accurate price forecasts to maximise market opportunities and advanced modelling to optimise operation while preventing unnecessary degradation.

What began as two research projects quickly grew. Over the years, our team developed sophisticated price forecasting models, while advancing the science of battery optimisation and trading. These parallel research streams finally converged into OptiGrid's founding mission: to unlock the full potential of grid-connected batteries.

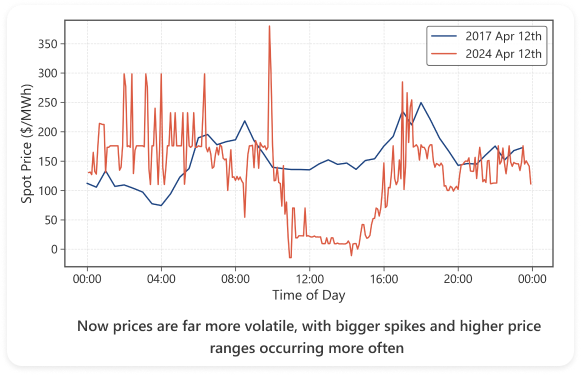

South Australia has gone quickly from a fossil-powered laggard to having the world’s highest share of wind and solar in a gigawatt-scale grid, with a 75% share at June 2024. The state is targeting 100% net renewables by 2027. And it’s also part of Australia’s National Energy Market, which was one of the first jurisdictions globally to move to 5-minute settlements. While this is a cause for celebration, it comes with big challenges for energy market operators.

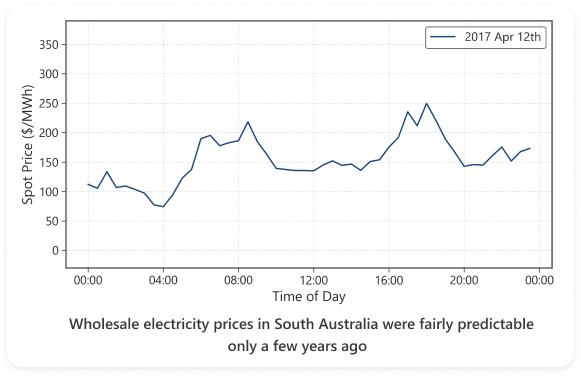

Think crypto or pork belly futures are volatile? They have nothing on Australian energy prices. The graph above shows electricity prices in South Australia on one day in 2017. In those days energy prices were much more predictable. Prices peaked when everyone got up and turned on the kettle in the morning, and in the evening when we came home from work.

Just seven years later, it’s a very different and much more unpredictable story. Prices commonly go negative in the middle of the day when renewable generation exceeds 100% of demand. At other times, the market peaks at 2x or 3x times the price it used to peak at. Forecasting electricity prices and responding to them just got so much harder. And it’s likely to get harder as the transition continues. We’re addressing these challenges by building tools that help energy assets, particularly batteries, operate at the right times. Our solutions improve market efficiency and accelerate the adoption of renewable energy sources.