OptiBidder

Smarter energy trading powered by OptiBidder

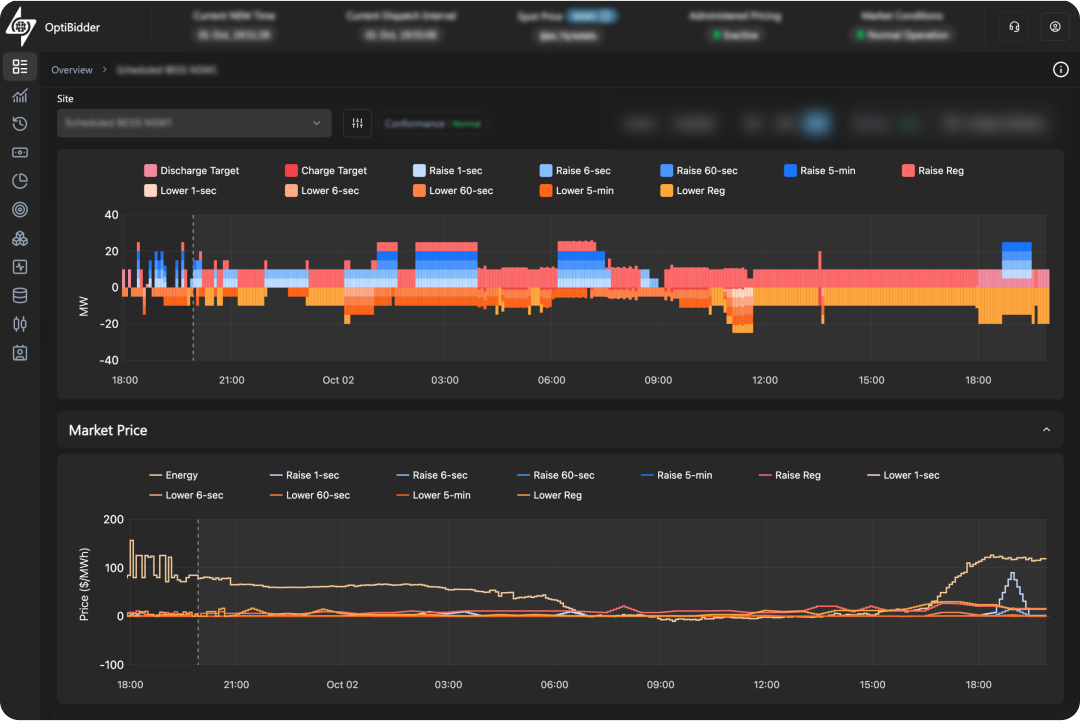

OptiBidder combines market-leading forecasting with intelligent bidding algorithms to optimise battery trading performance in Australia’s NEM. Backed by deep local market knowledge, we work directly with asset owners, developers and operators to align our platform with each project’s commercial goals and operational constraints, maximising returns over the life of the asset.

Maximise BESS returns

What we manageOptimised Assets,

Optimised Assets,

Maximised Returns.

OptiGrid provides asset optimisation and trading solutions designed specifically for Australia's National Electricity Market (NEM).

Utility-Scale Batteries and Hybrids

Optimising operations and bidding for Scheduled batteries to maximise financial returns across available markets and contracts, while ensuring compliance with market rules.

Non-Scheduled Batteries and Hybrids

Providing dispatch optimisation and market participation for non-scheduled sub-5 MW batteries, maximising energy arbitrage, FCAS revenue, and other business objectives. Suitable for both stand-alone and DC-coupled or AC-coupled hybrid systems.

Renewable Plants

Managing operations and bidding for solar and wind farms to maximise revenue across markets and contracts, while minimising exposure to negative prices and FCAS costs.

How we're different

Why OptiBidder?

Higher returns from projects

Independent testing and customer results show OptiBidder delivers up to 40% higher returns than other solutions. Our proprietary machine learning models and bidding algorithms, help your batteries capture more value across available markets and contracts.

Agnostic and independent platform

OptiGrid is fully independent of any battery OEM or operator, with optimisation tailored to each asset. It delivers consistent performance across battery types, aligned with your goals, and free from competing interests.

Built for the NEM

Built on years of research, we apply ML-based forecasting and battery optimisation designed for Australia's NEM to unlock the full potential of your battery. Our platform continuously learns and adapts, improving performance over time.

Continuously tested and constantly improving

We use advanced backtest modelling systems to accurately simulate real-world conditions, ensuring our platform consistently exceeds performance expectations.

Capabilities

We help you deploy more batteries, smarter

We deliver a complete solution designed to seamlessly integrate your assets and maximise returns across all markets and contracts.

Progressive Technology

Leveraging state-of-the-art AI and machine learning to maximise returns from batteries.

Contract Management

Tailored handling of tolling agreements, firm offtakes, PPAs, and other contractual positions, supported by our modelling capabilities.

Easy Integration

Cloud APIs and hardware interfaces for asset integration and direct market access for bidding.

Full Market Coverage

Optimised bidding and operations across wholesale energy and FCAS markets.

Advanced Simulation

Accurate backtesting and live simulations for reliable insights and safe evaluation prior to deployment.